Most people who place a sports bet do so with a vague sense of confidence and little else. They like a team, they trust a feeling, and they put money down.

The ones who come out ahead over months and years do something different. They treat betting as a numbers problem.

They size their bets according to formulas, shop for the best price on every line, and track their results the same way a small business tracks its books. The gap between these two groups has nothing to do with luck and very little to do with sports knowledge.

It comes down to process. According to industry reporting, Americans legally wagered $149.90 billion on sports in 2024, and commercial sports betting revenue reached $13.78 billion that same year, a 24.8% increase from the prior year.

As of February 2026, 39 states plus Washington, D.C. and Puerto Rico have live sports betting, with 30 of those states offering online wagering through apps and websites. Roughly 20% of U.S. adults placed a sports bet in 2025, spending an average of $3,284 per year.

That is a significant amount of money moving through the market, and most of it moves without a structured sports betting strategy behind it. This article outlines a practical framework for smart sports betting built around math, discipline, and long-term thinking.

Table of Contents

What Positive Expected Value Actually Means

A bet has positive expected value (EV) when the probability of it winning is higher than the probability implied by the odds you are getting. If a sportsbook prices a team at +150, the implied probability is about 40%.

If your own analysis puts that team’s chances at 45% or better, the bet has positive expected value. You do not need to win every time.

You need to place enough positive EV bets over a long enough stretch that the math works in your favor. Over hundreds of wagers, even a small edge compounds.

Finding these spots requires comparing your own probability estimates against the odds posted by sportsbooks. Some bettors build statistical models.

Others rely on consensus lines and known market inefficiencies, such as public bias toward favorites or inflated action on primetime games. The key is that each wager should be grounded in numbers, not in gut feeling.

Stretching Your Bankroll With Sign-Up Offers

Most sportsbooks offer bonus credits or deposit matches to new users. Stacking these across platforms is one of the simplest ways to reduce your initial risk.

You can compare bonus codes on covers.com, first-bet promotions, and similar offers before committing funds to a single book.Treat each bonus as additional bankroll padding rather than free money.

The important step is reading the terms attached to each offer. Rollover requirements and minimum odds conditions vary by platform, and those details determine whether the promotion fits into your overall betting strategy.

Line Shopping and Why a Half-Point Matters

Sportsbooks rarely post identical odds on the same game. One book might list the Chiefs at -3, another at -2.5. That half-point difference changes the outcome of the bet a measurable percentage of the time over a full season.

Bettors who hold accounts at multiple books and compare lines before placing each wager gain a small but consistent edge. This practice, known as line shopping, is foundational to smart sports betting.

The time required to check three or four apps is minimal. The long-term impact over hundreds of bets is meaningful.

Sizing Your Bets With Fractional Kelly

The Kelly Criterion is a bankroll management formula that calculates what percentage of your bankroll to wager based on your edge and the odds offered.

Full Kelly maximizes theoretical long-term growth but produces significant volatility. Because variance is unavoidable, many disciplined bettors use fractional Kelly staking.

If full Kelly suggests betting 6% of your bankroll, half-Kelly reduces that to 3%, and quarter-Kelly to 1.5%.

Smaller bet sizing protects your bankroll during inevitable losing streaks and keeps you positioned for long-term sustainability.

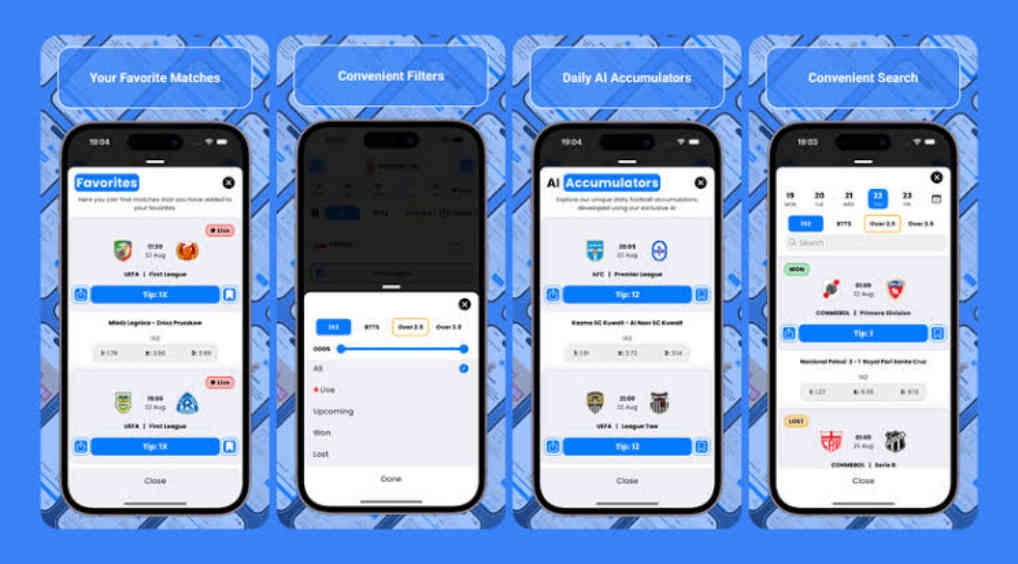

AI-Powered Tools and Their Limits

The market for AI-driven betting analytics is projected to grow from roughly $1.7 billion in 2025 to $8.5 billion by 2033. These tools analyze large datasets across major leagues to generate projections and identify potential value.

Most predictive systems deliver between 50% and 60% accuracy. Against standard -110 odds, the break-even point sits near 52.4% after accounting for the sportsbook’s vig.

A consistent 55% win rate can be profitable over time, but AI should be treated as one input among several. It does not replace disciplined bankroll management or thoughtful analysis.

Keeping Records and Reviewing Your Bets

Profitable bettors track every wager. Record the sport, line, odds, stake size, result, and the reasoning behind each bet. Without records, you cannot identify patterns in your performance.

Monthly reviews often reveal trends. You may discover that NFL sides are profitable while NBA totals consistently underperform.

That insight allows you to reallocate time and capital toward areas where you hold a measurable edge. Tracking transforms betting from impulse to structured evaluation.

Discipline Is the Real Edge

Smart sports betting is not about predicting every outcome correctly. It is about building a repeatable system. Positive expected value identifies opportunities.

Line shopping improves pricing. Fractional Kelly staking manages risk. Bonuses reduce early exposure. AI tools provide additional data context.None of these components guarantee success on any single wager.

Combined and applied consistently, however, they create a disciplined sports betting strategy designed for long-term sustainability rather than short-term excitement.

In the end, the difference between casual bettors and strategic bettors is not luck. It is structure, patience, and consistent execution over time.

Frequently Asked Questions

What is positive expected value in sports betting?

Positive expected value means the true probability of a bet winning exceeds the probability implied by the odds. Over many bets, consistently identifying positive EV positions provides a mathematical advantage.

What is the Kelly Criterion?

The Kelly Criterion is a bankroll management formula that calculates optimal bet size based on your perceived edge and the odds offered. Many bettors use fractional Kelly to reduce volatility.

Is line shopping really necessary?

Yes. Even small differences in spreads or odds can significantly impact long-term profitability. Comparing prices across sportsbooks is one of the simplest ways to improve results.

Can AI tools make sports betting profitable?

AI tools can help identify trends and potential inefficiencies, but they do not guarantee profit. They work best when paired with disciplined staking and record-keeping.

How much of my bankroll should I risk per bet?

Many disciplined bettors risk between 1% and 3% of their bankroll per wager, depending on their edge and risk tolerance. Smaller allocations help protect against variance.

Is sports betting profitable long term?

It can be, but only for bettors who consistently identify positive expected value opportunities, manage bankroll responsibly, and maintain disciplined processes over hundreds or thousands of wagers.